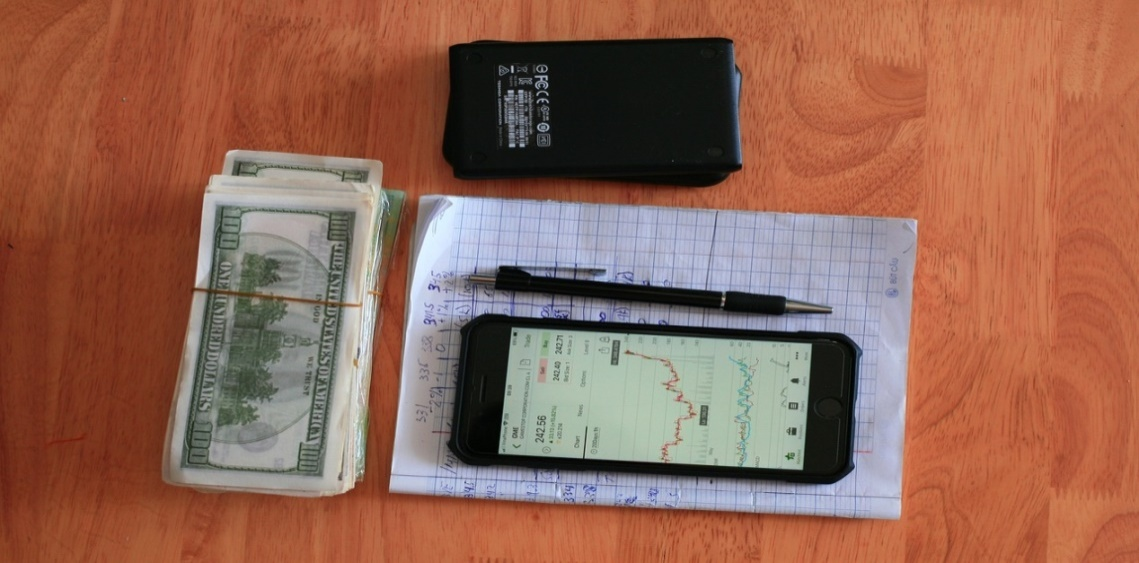

Many businesses and individuals in the US struggle to manage their cash flows because of financial difficulties. Many retail behemoths have recently declared bankruptcy due to a lack of funds to repay their debts.

You may have a low credit score because you failed to make timely payments. However, a low credit score can make it difficult for you to get traditional loans. Here’s why you might have a low credit score.

1. Utility Billing

Utility payments made on time directly influence your credit ratings. Your credit score can suffer if you don’t pay your gas and electricity bills on time. To ensure that you pay your utility bills on time, we recommend that you form a payment plan.

You should avoid late bill payments because they might stay on your credit report for up to seven years. Eliminate unnecessary expenses to save money for your power bills so that you can pay your bills easily without delay.

2. Credit History Length

Credit score also has much to do with how long you have taken credit for. If you do not make timely payments and have unpaid debt, you will have a bad credit score.

3. Debt Threshold

Your credit score is directly proportional to the amount of debt you have. The more debt payments you have, the lower your credit score will be. To get your credit score back on track, you should concentrate on debt repayment strategies and find ways to repay your loans as soon as possible.

Benefits of Good Credit Scores

Your creditworthiness and financial situation are represented numerically by your credit score. It’s a significant aspect of your financial profile.

A good credit score gives you an advantage over your peers in several situations, including loan approvals and credit card advantages. A low credit score can raise the cost of your financial transactions.

Here’s a breakdown of some lesser-known benefits of having a good credit score.

1. Increases the Likelihood of Obtaining a Credit Loan

Have you been turned down for a credit card or a loan before? If you answered yes, you know how aggravating it may be. If you are denied funding for something you desire, such as a hot property to set up your new office or expand your business, you may find yourself in a difficult situation.

Your chances of securing a loan are better if you have a good credit score. Although your credit score isn’t the only element taken into account by lenders, it is one of the most important.

2. Lower Interest Rates

Lower interest rates on your loans are one of the key advantages of having good credit. A higher score ensures lending institutions or private lenders will charge lower interest rates when giving out a loan or even issuing a credit card.

Candidates with good credit scores get the best rates, while those with bad credit frequently pay higher interest rates.

3. Will Give You Priority for A Few Positions

A personal credit check is essential for some jobs, such as those dealing with money or requiring a security clearance. This demonstrates that you are financially secure and will not accept bribes because of your financial difficulties.

If you have a poor credit rating, you may be unable to obtain some employment, such as those in customs or banking, because the authorities may be concerned that you would engage in corrupt practices because of your financial difficulties.

Tips to Boost Your Credit Score

Credit reports store all your financial information, such as whether you’ve been sued or filed for bankruptcy. It’s a piece of paper that financial organizations use to see if you’re qualified for a loan.

Your credit score also influences the terms of your loans. Poor financial decisions might result in a less-than-stellar credit report, but there are steps you can take to improve it. Here are a few trusted ways to boost your credit score.

1. Look Through Your Credit Report

Obtaining a copy of your credit report from any credit reporting agency is the first step in clearing it up. Every CRA can only provide you with one complimentary copy.

Experts advise receiving one from each because they each provide different information that can help you improve your credit ratings. Many people turn to specialized consumer reporting firms, which may be able to offer you even more information.

2. Lower Your Credit Utilization Ratio

The credit usage ratio measures how much credit you use compared to available credit. When you use credit cards frequently, you have a higher credit utilization ratio, which reduces your credit score and shows you’re a financial risk.

You must keep your credit use ratio low to maintain a decent credit score. Using a balance transfer card is one of the techniques that experts recommend. Because these loans offer lower interest rates, you can reduce your credit usage ratio and pay off all of your present loans faster.

3. Watch Out For Any Reporting Mistakes

Credit reports, while meticulously compiled, may contain mistakes on occasion. You have the right to fight the error, but you’ll need proof to back up your claim.

Unless you’re an accounting or finance expert, you’ll need the help of a professional who can discover errors in your credit report in this case.

Don’t have favorable credit ratings? First Nations Finance LLC can assist you in obtaining the funds you require to repair and resell properties for a profit. We’ve been in the private lending business for more than thirty years and have clientele in fifty different states.

We offer financing options, including fix & flip loans, mixed-use lending, construction loans, office building financing, and industrial property loans in Dallas and Middlesex.

Reach out to us today for fast and efficient hard money loans.